Fuel Your Future in the Business World

Drive real results in the fast-paced financial industry with a Bachelor of Science in Financial Information and Analysis from Clarkson University. Whether on Wall Street, for the Big 4 or by starting your own venture, you will be prepared to move, manage and make money work to your advantage.

Why Major in Financial Information and Analysis at Clarkson?

Our program provides advanced practical skills in accounting, investment and money management. As a student, you will have the opportunity to build your résumé via high-quality internships and exciting global experiences. Our program is rigorous and has brand recognition — we are considered one of the best business schools in the country by The Princeton Review and U.S. News & World Report.

The skills you will develop are sought after by prestigious financial institutions. Approach investments with a strategic mindset. Understand what accounting methods to apply in different business ventures and their tax implications. Learn how to allocate capital to meet your organization's goals.

Classes are hands-on and focused on real-world scenarios. Our faculty are renowned entrepreneurs and scholars who will give you personalized guidance for your future. As a student, you will also have the opportunity to manage part of the university's endowment fund as part of your training. By the time you graduate, your experience will set you apart in the job market.

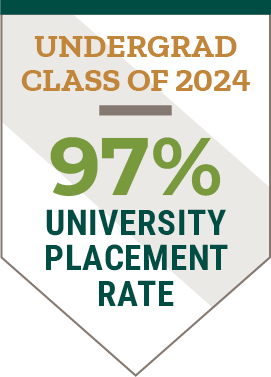

And, our Financial Information & Analysis Class of 2024 had a 100 percent placement rate.

What You'll Learn

You will complete classes in business fundamentals for the first two years of the program. You will then take the required courses for the major and other specialized courses. You can use electives to fulfill a track or minor or explore other fields.

The core requirements for the major are:

- Cost Accounting

- Financial Management II

- Intermediate Financial Accounting I

- Intermediate Financial Accounting II

- Investments

- Strategic Financial Management